One of the most important lessons every trader should observe is risk management. This is the difference between keeping and making more money, or losing money and going broke. It may sound like an easy, straightforward principle, yet it is still one that most often violated rules that traders either forget or ignore. Therefore, to help anyone new to the industry stay from losing all their money, a simple to follow rule was coined the 2% rule.

How does this 2% rule work?

It is very simple actually; just don’t risk more than 2% of your account balance on a single trade. For example, if your account balance is $10,000, no single trade should have more than a $200 margin (2% x 10,000). With every subsequent trade, you keep limiting your risk to 2% of the remaining margin, rather than sticking to the original $200. Therefore, on the second trade, had you lost the first trade, your maximum risk would now be $196 (2% x $9,800).

Why is this rule important?

The idea behind this 2% rule is to reduce the maximum amount of losses you can experience while trading. Nobody likes to lose on trades of course, but it does happen, even to the best traders. Sometimes you can experience a series of losing trades, and the 2% rule protects your account on such times.

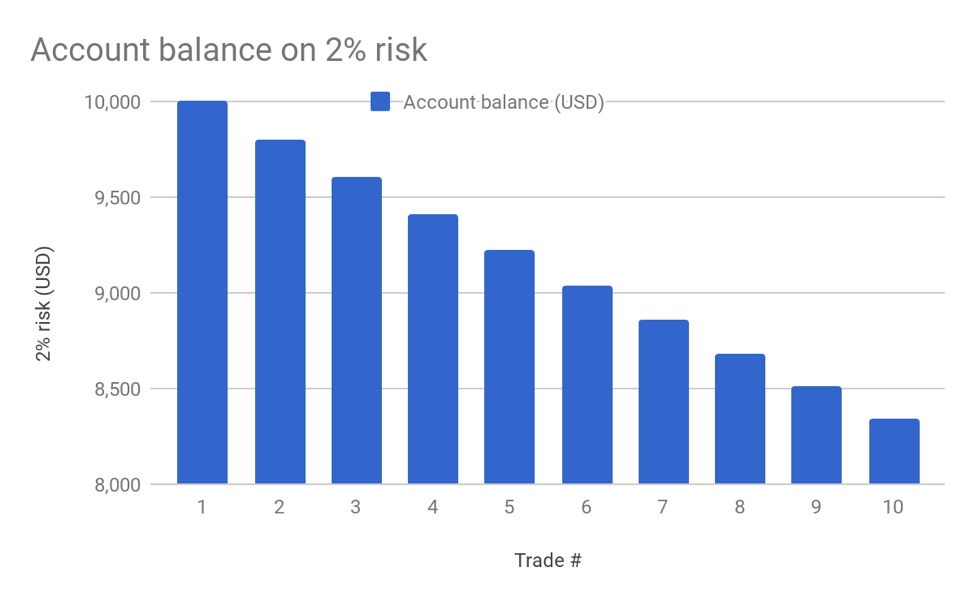

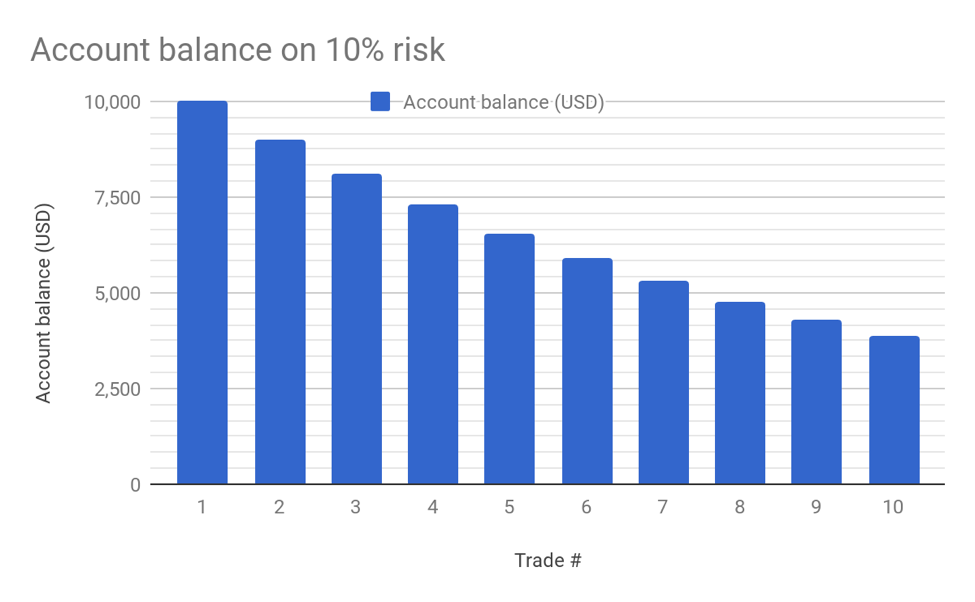

Imagine two traders starting off with the same $10,000, where one observes the 2% rule while the other does not. Assuming both traders experience a streak of 10 losses continuously, let’s see what happens afterwards.

This first case represents a trader who maintained a 2% risk throughout the trading period. Even though they lost 10 consecutive trades, the account balance remained to be $8,174. That is about an 18% loss on the account, which is devastating, but still possible to recover. In order to break even, this trader would have to make about a 22% profit. Now let’s look at the other trader.

This first case represents a trader who maintained a 2% risk throughout the trading period. Even though they lost 10 consecutive trades, the account balance remained to be $8,174. That is about an 18% loss on the account, which is devastating, but still possible to recover. In order to break even, this trader would have to make about a 22% profit. Now let’s look at the other trader.

After 10 consecutive losing trades, this trader is left with just $3,489 in their account, making a 65% loss. Now that is a terrible loss! For them to break even again at $10,000, it would take a 186% profit in the following trades, which is almost impossible. As you can see, this trader is in big trouble because they have lost a major portion of their capital and the prospect of making it back is bleak.

After 10 consecutive losing trades, this trader is left with just $3,489 in their account, making a 65% loss. Now that is a terrible loss! For them to break even again at $10,000, it would take a 186% profit in the following trades, which is almost impossible. As you can see, this trader is in big trouble because they have lost a major portion of their capital and the prospect of making it back is bleak.

This is why the 2% rule is so important – it recognizes that there are going to be bad trading days, and protects your from the worst case scenario. In fact, newbies may even be advised to lower the amount of risk, perhaps down to 1% to further minimize the risk. If an expert trader can experience a 10-trade losing streak, it is possible for a newbie to have an even worse case. Besides, an expert and successful trader has a better chance of making back lost money compared to an amateur.

Why do so many ignore this rule?

If the benefit of the 2% rule is so clear, the question now becomes why so many traders have chosen to ignore it and suffered the consequences. The main reason is simply greed. The adrenaline of trading can sometimes take over you that you ignore the basic rules. A trader may suddenly see the 2% rule as restrictive and decide to ignore it when they feel very sure of themselves in order to gain bigger profits. The problem is that this cavalier attitude may work at first, leading someone farther away from the rule.

To help you adhere to the rule, you have to view forex trading as more of a marathon than a race. Major short-term returns should not matter as much as the long-term. This is how successful investors like Warren Buffet invest, and you should too.