This is a guest post from UK life insurance broker, Reassured.

The rise of the e-cigarette

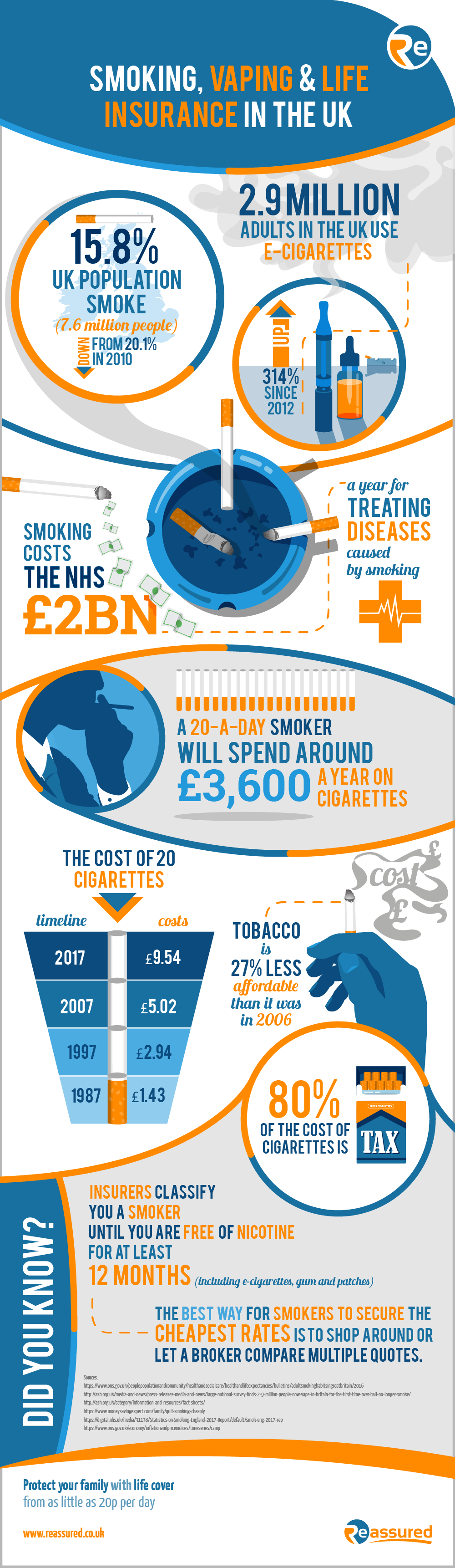

In recent years, while there has been a reduction in the number of UK smokers, the nicotine replacement market has exploded.

Whether it be chewing gum, patches, nasal sprays and perhaps most significantly e-cigarettes, there are now loads of nicotine replacement products available.

These are seen by many as an important stepping stone on the road to quitting and can prove effective in weaning smokers off cigarettes.

Did you know, as an industry, e-cigarettes is on course to exceed a staggering £2bn in the UK by 2020.1

As our young adults move away from super expensive smoking, they are moving in their numbers towards alternative products.

The prevalence of vapers amongst 16 – 24-year-olds increased from 2% in 2015 to 6% in 20162, and is still rising.

Did you know that you have to give up smoking for a minimum of 12 months for insurers to regard you a non-smoker?

The cost of smoking is soaring

If you are a smoker in the UK you’ll be well aware of how expensive it has become.

In 1987, a pack of 20-cigarettes cost £1.43, then £2.94 in 1997, which rose to £5.02 in 2007, before reaching £9.54 in 20176.

The NHS suggests that tobacco is 27% less affordable than it was in 20065.

Why not make 2018 the year you quit smoking?

Over 80% of the cost of cigarettes in the UK is made up of tax? Isn’t it time you stopped paying all your money to the tax man?6

The impact on life insurance premiums

We know that insurers treat smokers differently because statistically, they are more likely to claim. To mitigate the increased risk, they charge higher premiums, compared with non-smokers with similar coverage.

Insurance provider SunLife suggests smokers could pay as much as 75% more on their monthly life insurance premiums3.

Whereas, research published on MoneySavingExpert4 suggests this increase is even higher, at 96% for a fixed term £200,00 policy over 20 years! (£6,960 for a smoker vs £3,552 for a non-smoker, based on a 40-year old).

Are you aware that insurers still classify you as a smoker if you use nicotine replacement products? As a result, your premiums are likely to be the same as that of a cigarette smoker.

Save £1000’s on cigarettes & reduce your insurance premiums

Why not take this opportunity to save yourself £1,000’s in 2018 and increase your life expectancy by giving up smoking?

There has never been a better time to quit; the costs are spiralling, there are numerous replacement products available, online websites like www.givingupsmoking.co.uk/ can offer help.

The average smoker currently smokes 11 cigarettes a day5. Which means a cost of approximately £1,800 a year.

Why not join the growing number of ex-smokers who have taken up vaping? But with a long-term vision to wean yourself off e-cigarettes over a 6-month period.

Sources:

[1] www.theguardian.com/business/2017/jun/30/ten-years-after-the-smoking-ban-vaping-is-a-1bn-business

[2] https://digital.nhs.uk/media/31138/Statistics-on-Smoking-England-2017-Report/default/smok-eng-2017-rep

[3] www.sunlife.co.uk/life-cover/life-insurance/life-insurance-for-smokers

[4] www.moneysavingexpert.com/family/quit-smoking-cheaply

[5] www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/healthandlifeexpectancies/bulletins/adultsmokinghabitsingreatbritain/2016

[6] http://the-tma.org.uk/policy-legislation/taxation